Paying off student loan debt can be plenty challenging enough when you are trying to finance your

own education; but parents who borrow to help put their children through school are in a whole other

league when it comes to repaying the loans.

That’s partially due to the fact that parents are usually in a different stage of life when they take

on this kind of vicarious student debt. Think about it: the parent borrower will almost always be in his or her forties when they sign up for parent loans, and with many extended repayment plans may be well past retirement age before they finish paying them off.

Adding to this, the most popular form of parent lending for education, Parent PLUS loans, have no formal maximum limit on the amount that can be borrowed, parent may feel responsible for helping multiple children, and some of those children may be seeking advanced degrees that take a decade or more to obtain. It can quickly add up to a whopping debt that, while incurred for a noble cause, overwhelms the parents just when they are eyeing retirement.

Since Parent PLUS loans are federal loans, the first instinct borrowers have is to shop around for one of the several income-based repayment plans offered by the federal government. Unfortunately, the news here is bad: Parent PLUS loans (unlike PLUS loans offered directly to graduate students) are formally barred from all these repayment plans except one.

The sole relief program that will accept Parent PLUS loans is called Income Contingent Repayment, or ICR. Unfortunately, this is one of the oldest programs out there, and requires borrowers to commit 20% of their disposable income each month to debt payment. This may be a viable option for one or two small loans, but can produce staggering payments for parents who leaned heavily on these loans for their kid’s schooling. The newest, and usually friendliest repayment plan, dubbed SAVE, formally bars parents from enrolling their PLUS loans.

But — there may be a workaround, although it requires tenacity and a daunting amount of paperwork. While Parent PLUSloans are ineligible for SAVE and other plans, “direct” federal student loans are eligible, so the trick is to turn a PLUS loan into a direct loan in order to qualify.

Enter the “double consolidation,” in which parent debtors put their PLUS debts through a series of debt consolidations to get them converted into direct loans. Here’s how it works:

Campus photographs taken by Freelancer Conor Doherty during a summer day.

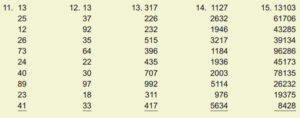

First, parents need to have multiple PLUS loans. A single loan is stuck with ICR. But multiiple loans

(which should be the case if the child attended school for more than one year), can be divided into two groups of loans, each one ripe for consolidation.

Because parents can choose their loan servicer on the consolidation application, they will begin by filling out the forms and requesting the first group of loans be consolidated into one direct loan, and then

choosing a servicer such as Nelnet.

A second application is simultaneously prepared, listing the remaining PLUS loans for consolidation, and a DIFFERENT servicer is requested.

When both consolidation applications are submitted and approved, the result should be that the parent now owes on two direct federal loans, payable to two different servicers. While these loans are direct federal loans, they still carry the PLUS designation, so an additional step is needed.

You guessed it: the borrower next prepares a third consolidation application, this time asking that the two new loans be combined into one, and chooses the ultimate servicer of choice. If the parent thinks they might

be a good candidate for public service loan forgiveness based on their employment status, MOHELA should be selected.

When this last application is submitted and approved, the result should be one single direct federal loan, created from the merger of two direct loans, eliminating the Parent PLUS status, and qualifying for a lower payment under the SAVE program. At this point, the SAVE application can be downloaded, and the final single direct loan can be enrolled.

Obviously, it helps to be the type of person who just loves government bureaucracy and filling out forms to pull this off, along with a healthy dose of patience, but the end result may be worth it, as payments calculated by SAVE will tend to be much lower than those offered by ICR.